SEEK NZ Employment Report - October 23

October 2023 Key Findings

NATIONAL INSIGHTS:

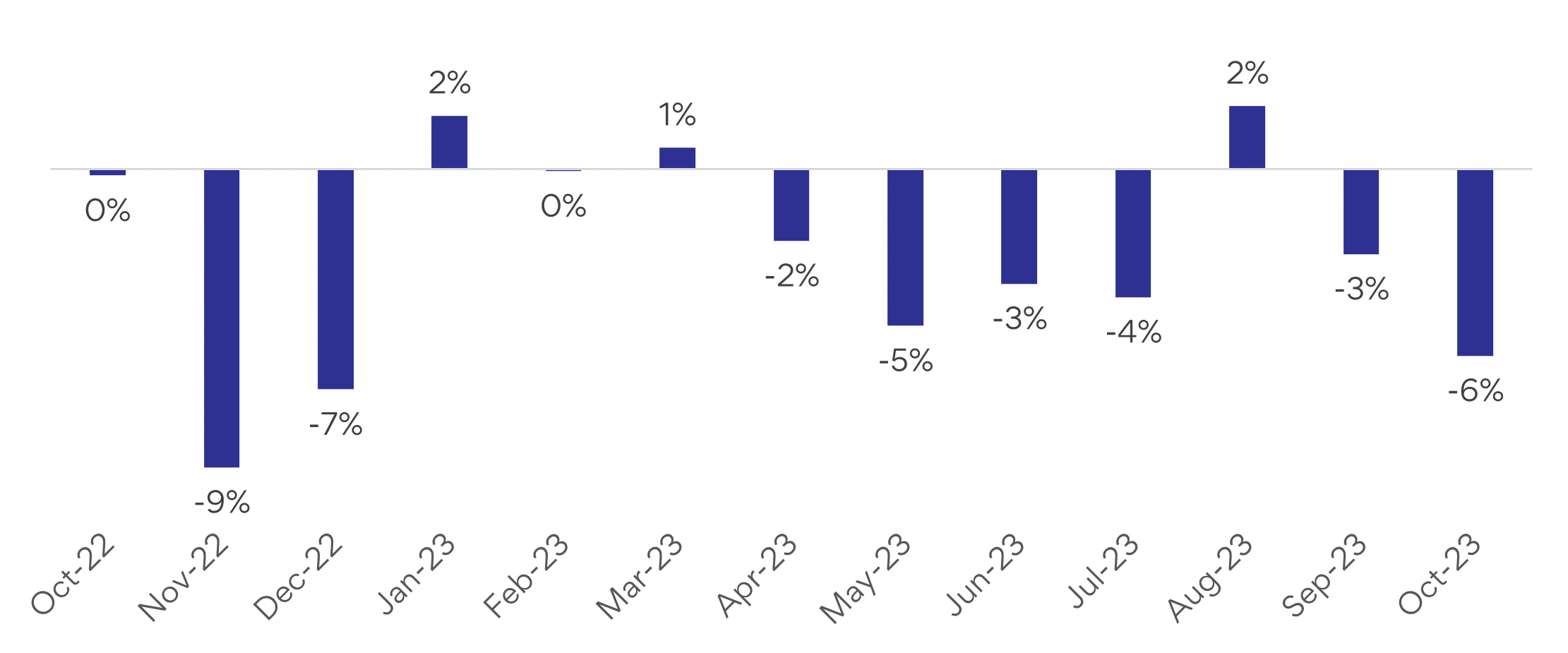

- Job ads declined 6% in October and are now 1% lower than October 2019 levels.

- After declining in August, applications per job ad increased in September, rising 4% month-on-month (m/m).*

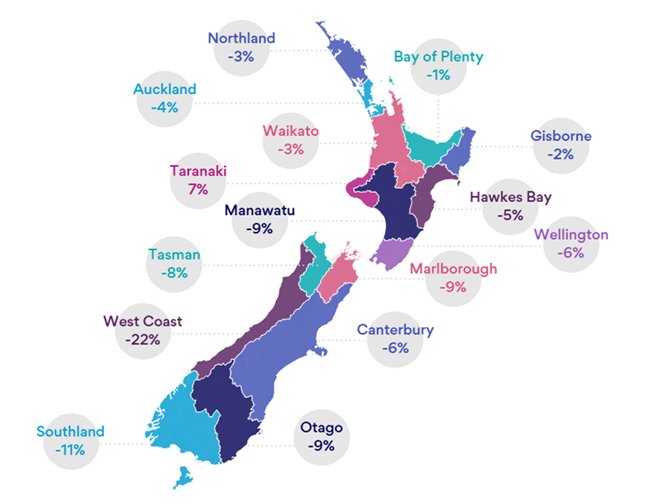

REGION INSIGHTS:

- All regions recorded a decline in job ads, aside from Taranaki, where volumes grew 7%.

- The largest cities drove the overall decline, namely Auckland (-4%), Wellington (-6%) and Canterbury (-6%).

INDUSTRY INSIGHTS:

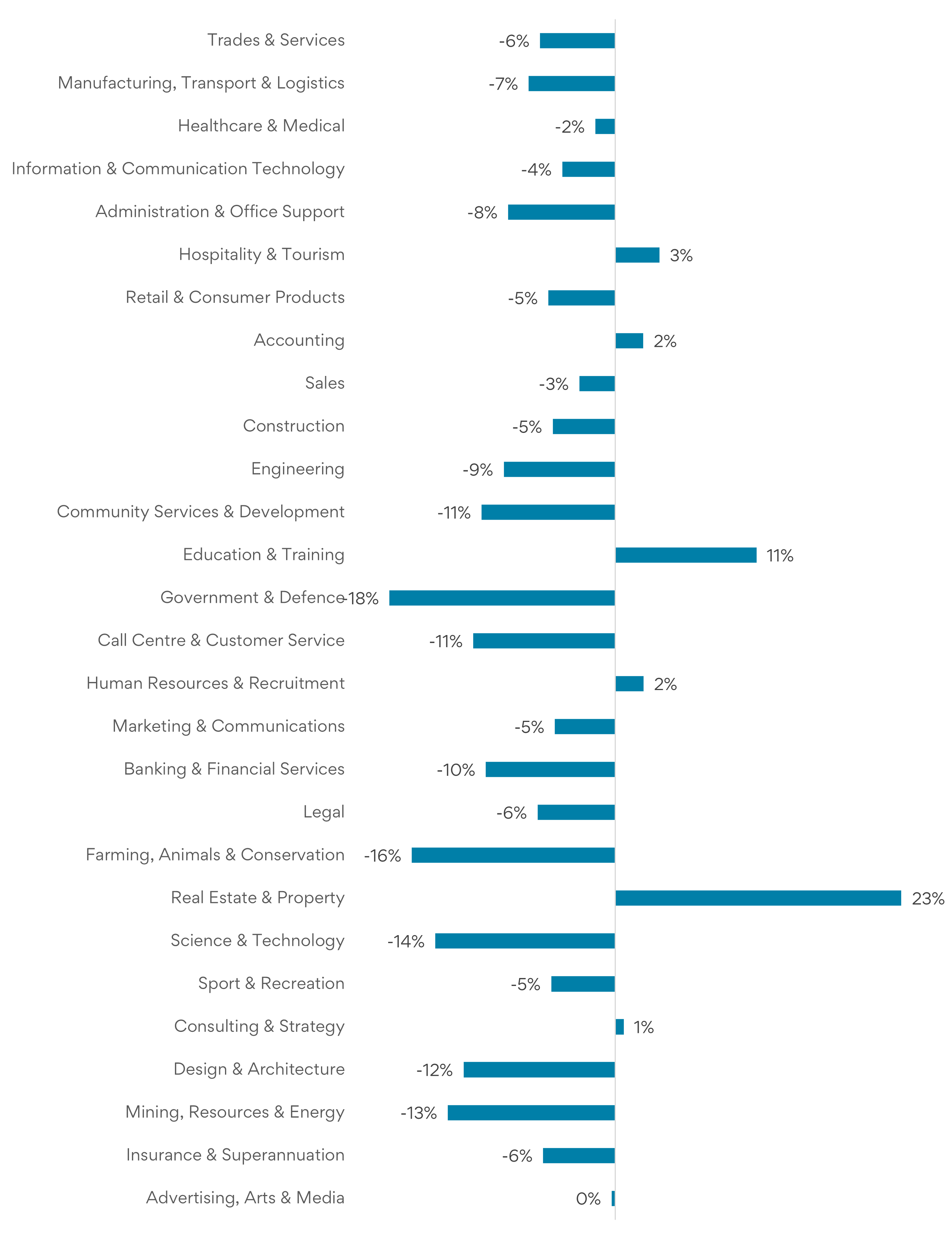

- The largest hiring industries recorded m/m decline in job ads, led by Manufacturing, Transport & Logistics which dropped 7% m/m.

- Real Estate & Property was one of the few industries to record growing demand for workers, rising 23%, while job ads in Education & Training.

*Applications per job ad are recorded with a one-month lag. Data shown in this report refers to September data.

.png)

Figure 3: National SEEK job ad percentage change by region (October 2023 vs September 2023)

INDUSTRY INSIGHTS

The industries that drove the overall decline in job ads in October were Manufacturing, Transport & Logistics (-7%), Administration & Office Support (-8%) and Trades & Services (-6%).

Not all industries recorded a fall, with Real Estate & Property (23%) and Education & Training (11%) among the six industries to increase m/m.

In Education & Training, demand for Teaching Aides & Special Needs Educators rose 49% m/m, and Tertiary Teachers increased 35%. In Real Estate & Property, Body Corporate & Facilities Management jobs rose 38%.

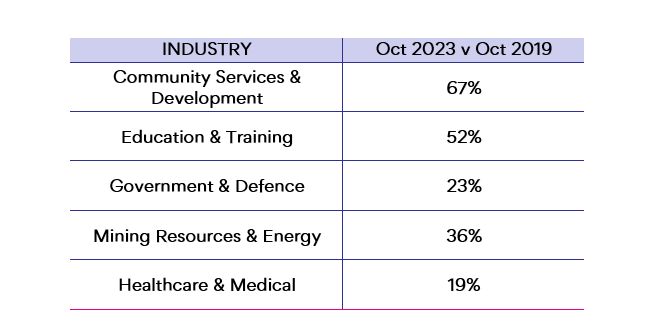

When compared to pre-COVID, some industries are recording higher demand for workers, specifically, Community Services & Development (67%) and Education & Training (52%).

Table 2: The top 5 industries for job ad growth October 2023 v October 2019.

Applications per job ad rose in most industries, and of the largest by job ad volume, Administration & Office Support increased 11%, followed by Accounting (10%) and Information & Communication Technology (9%).

Figure 4: National SEEK Job Ad percentage change by industry (October 2023 vs September 2023) – Ordered by job ad volume

MEDIA NOTE: When reporting SEEK NZ data, we request that you attribute SEEK NZ as the source and refer to SEEK NZ as an employment marketplace.

-ENDS-

Disclaimer

The Data should be viewed and regarded as standalone information and should not be aggregated with any other information whether such information has been previously provided by SEEK Limited, ("SEEK"). The Data is given in summary form and whilst care has been taken in its preparation, SEEK makes no representations whatsoever about its completeness or accuracy. SEEK expressly bears no responsibility or liability for any reliance placed by you on the Data, or from the use of the Data by you. If you have received this message in error, please notify the sender immediately.

About SEEK NZ

SEEK has been helping New Zealanders live more fulfilling and productive working lives since 1999.

SEEK is a diverse group of companies, comprised of a strong portfolio of online employment, educational, commercial and volunteer businesses. As a market leader in online employment marketplaces that span ten countries across Asia Pacific and Latin America, SEEK makes a positive contribution to people’s lives on a global scale.

About the SEEK New Zealand Employment Report

The SEEK Employment Report provides a comprehensive overview of the New Zealand employment marketplace. The report includes the SEEK New Job Ad Index, which measures only new job ads posted within the reported month to provide a clean measure of demand for labour across all classifications. SEEK’s total job ad volume (not disclosed in this report) includes duplicated job advertisements and refreshed job ads. As a result, the SEEK New Job Ad Index does not always match the movement in SEEK’s total job ad volume.