SEEK NZ Employment Report September - Job ads drop after a month of growth

NATIONAL INSIGHTS:

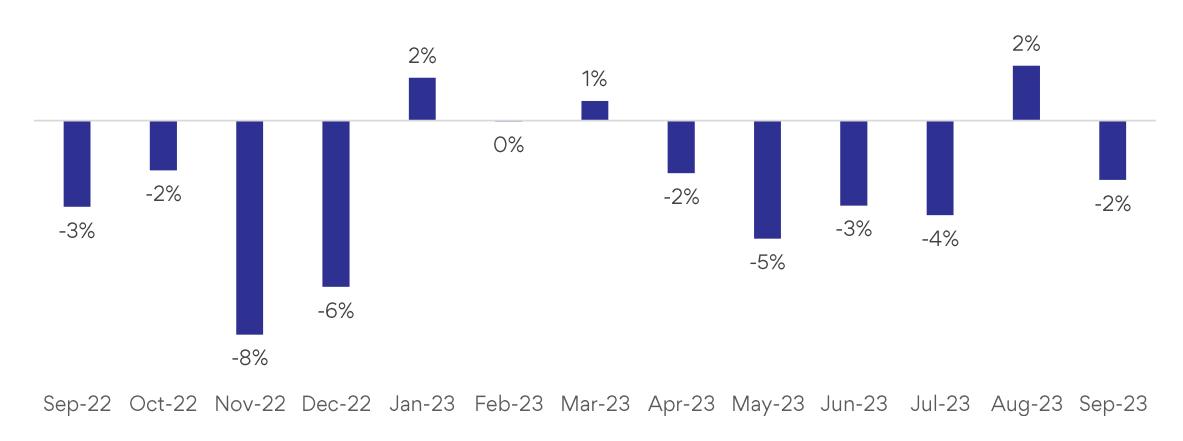

- After rising in August, job ads declined 2% September, and are now 1% higher than September 2019.

- Applications per job ad declined for the first time since January, dropping 4% month-on-month (m/m).*

REGION INSIGHTS:

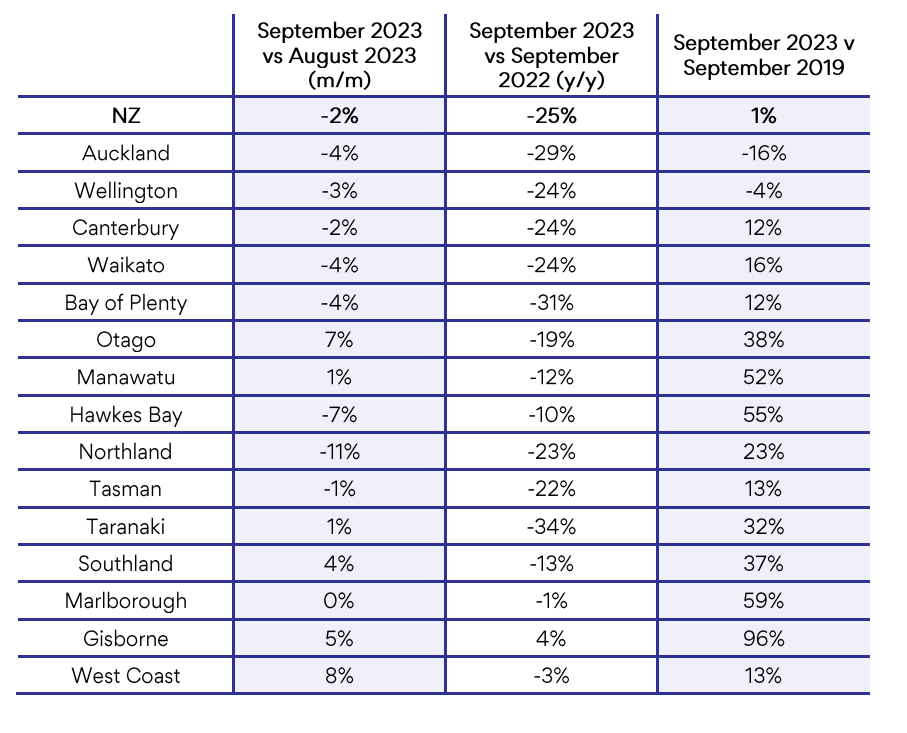

- Most regions recorded a decline in job ads in September, with Auckland (-4%) and Wellington (-3%) driving this.

- Otago (7%), Manawatu (1%) and Taranaki (1%) were the largest regions by job ad volumes to record a rise m/m.

INDUSTRY INSIGHTS:

- Demand for workers in Community Services & Development is now 80% higher than pre-COVID.

- Declining job ad volumes in Information & Communication Technology (-7%) and Administration & Office Support (-6%) drove the overall monthly decline.

*Applications per job ad data is recorded with a one-month lag. The data referred to in this report is August data.

Rob Clark, SEEK NZ Country Manager says:

“After four years, job ads volumes overall have returned to their pre-COVID normal levels. Some industries, remain significantly higher than they were in 2019, such as Community Services & Development, Government & Defence and Mining, Resources & Energy.

“Our urban areas of Auckland and Wellington are where job ads have fallen since pre-COVID, but all other regions are seeing job ad levels much greater, in some regions 50% and 60% higher.

“September recorded a 4% drop in applications per job ad, perhaps an indication that they are starting to plateau after two months of record-level applications. With application levels still so high, the balance of power, which had been so strongly with candidates for much of the past two years, is shifting to hirers.”

NATIONAL INSIGHTS

After a slight rise in job ads in August, they fell in September, dropping 2%. Volumes are now 1% higher than they were in September 2019, but 25% lower year-on-year (y/y).

The decline was driven by a decrease in job ad volumes in the largest urban regions, including Auckland, Wellington and Canterbury, as well as the largest industries.

Applications per job ad fell for the first time in seven months, but the 4% drop sees levels still at historically high levels, 118% higher than August 2019.

Figure 1: National SEEK job ad percentage change m/m September 2022 to September 2023.

Table 1: National and regional job ad growth/decline comparing September 2023 to: i) August 2023 (m/m), ii) September 2022 (y/y) and iii) September 2019.

REGION INSIGHTS

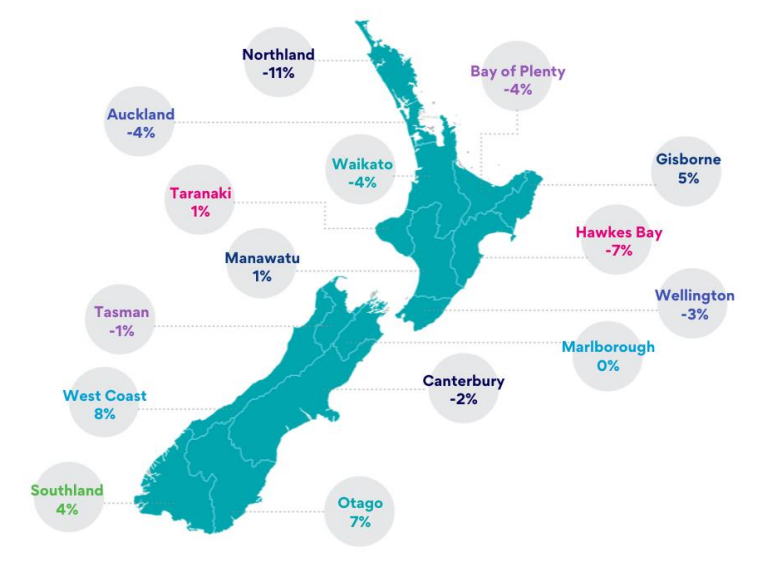

While the largest regions declined in job ad numbers, Otago (7%), Manawatu (1%) and Taranaki (1%), recorded small increases m/m, among others. Driving the growth in the smaller regions is the Industrial sector where job ads outside the cities rose 6%.

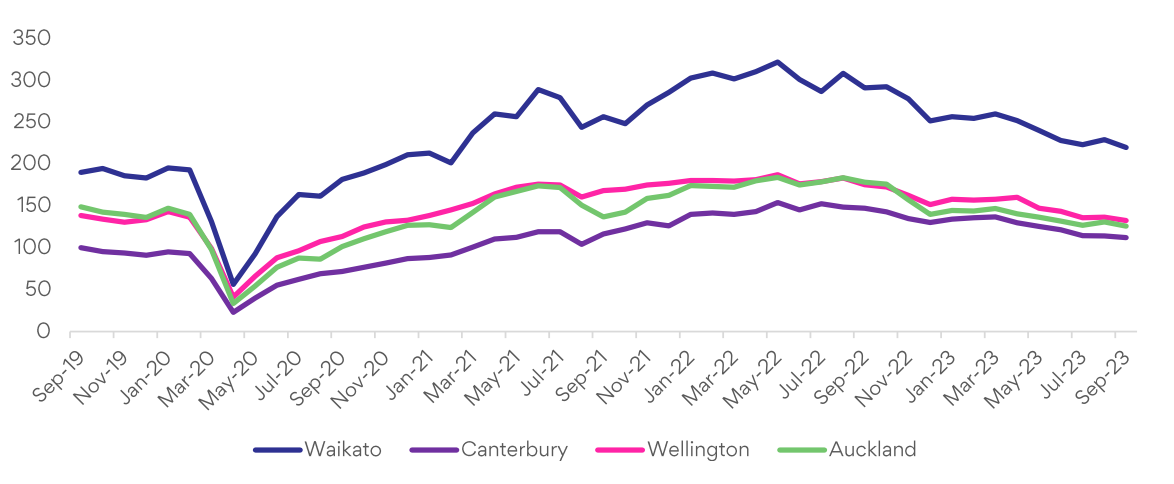

Auckland (-4%), Wellington (-3%) and Canterbury (-2%) led the national decline in job ad numbers.

When compared to pre-COVID, Auckland and Wellington are the regions that have not grown in job ad volume, down 16% and 4% respectively. All other regions are recording significantly greater volumes, with Hawkes Bay (55%), Manawatu (52%) and Otago (38%) some notable examples.

Hawkes Bay (2%) and Tasman (2%) were among the regions that saw an uptick in applications per job ads, but most regions declined from the month prior

Figure 2:Major centre job ad trends: September 2019 to September 2023 (Index:100 = 2013 avg)

Figure 3: National SEEK job ad percentage change by region (September 2023 vs August 2023)

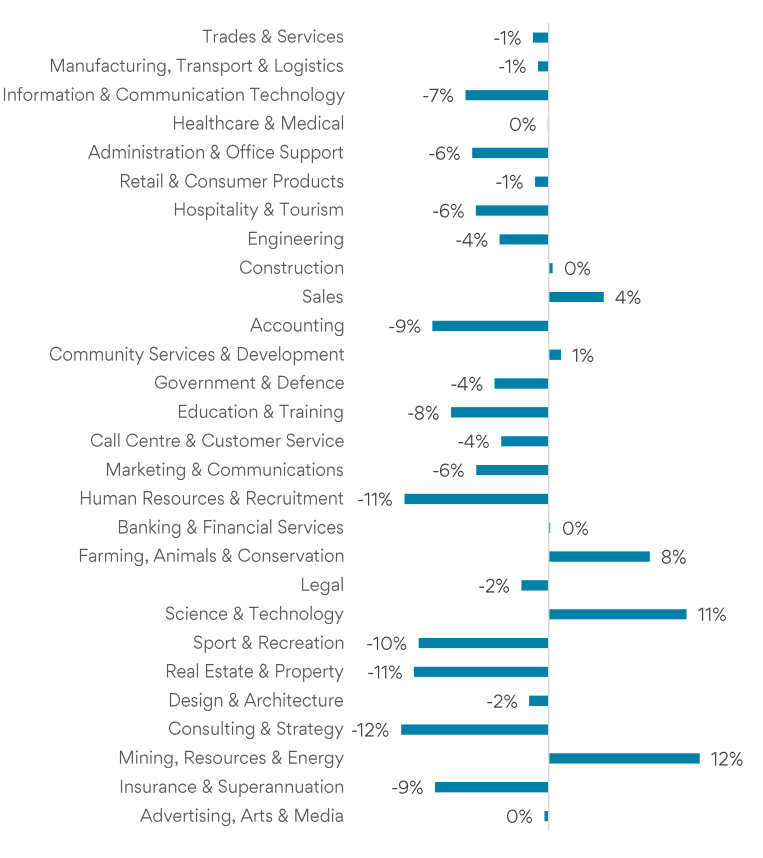

INDUSTRY INSIGHTS

The largest industry to record an increase in job ads in September was Sales (4%) followed by Community Services & Development (1%).

Just as the largest industries were responsible for the overall rise in job ads in August, they drove the overall decline in September; Trades & Services and Manufacturing, Transport & Logistics roles both dropped 1% m/m.

In comparison to September 2019, job ad volumes in some industries remain significantly high, such as Community Services & Development (80%). In recent months, this has been driven by growing demand for Managerial roles which have risen 73% since July.

Other industries that have grown considerably since September 2019 include Government & Defence (56%) and Mining, Resources & Energy (50%), whereas others have dropped significantly; Design & Architecture (-46%) and Information and Community Technologies (-28%).

Retail & Hospitality roles saw an increase in applications per job ad, rising 11% m/m, followed by Real Estate & Property (21%) and Farming, Animals & Conservation (16%).

Figure 4: National SEEK job ad percentage change by industry (September 2023 vs August 2023) – Ordered by job ad volume

MEDIA NOTE: When reporting SEEK NZ data, we request that you attribute SEEK NZ as the source and refer to SEEK NZ as an employment marketplace.

-ENDS-

Disclaimer

The Data should be viewed and regarded as standalone information and should not be aggregated with any other information whether such information has been previously provided by SEEK Limited, ("SEEK"). The Data is given in summary form and whilst care has been taken in its preparation, SEEK makes no representations whatsoever about its completeness or accuracy. SEEK expressly bears no responsibility or liability for any reliance placed by you on the Data, or from the use of the Data by you. If you have received this message in error, please notify the sender immediately.

About SEEK NZ

SEEK has been helping New Zealanders live more fulfilling and productive working lives since 1999.

SEEK is a diverse group of companies, comprised of a strong portfolio of online employment, educational, commercial and volunteer businesses. As a market leader in online employment marketplaces that span ten countries across Asia Pacific and Latin America, SEEK makes a positive contribution to people’s lives on a global scale.

About the SEEK New Zealand Employment Report

The SEEK Employment Report provides a comprehensive overview of the New Zealand employment marketplace. The report includes the SEEK New Job Ad Index, which measures only new job ads posted within the reported month to provide a clean measure of demand for labour across all classifications. SEEK’s total job ad volume (not disclosed in this report) includes duplicated job advertisements and refreshed job ads. As a result, the SEEK New Job Ad Index does not always match the movement in SEEK’s total job ad volume.