SEEK NZ Employment Report July - Applications per job ad at record high

*Applications per job ad data is recorded with a one-month lag. The data referred to in this report is June data.

Rob Clark, SEEK NZ Country Manager says:

“While job ad volumes have declined for the past four months, they remain just slightly higher than July 2019 figures, especially in the smaller regions, demonstrating there is still demand for workers. This is particularly true for the Community Services & Development and Sport & Recreation industries, where job ad volumes are significantly higher than pre-COVID.

“Applications per job ad are now at record high levels, meaning there is now more competition for the jobs available than ever before. We are seeing an increase in the number of applications that are coming from overseas, with the most applications directed at entry level or support services roles.

“Applications per job ad in Manufacturing, Transport & Logistics, and Community Services & Development rose by 24% month-on-month, which is an incredible amount. Aged & Disability Support roles saw a 51% increase in applications per ad in June alone.”

NATIONAL INSIGHTS

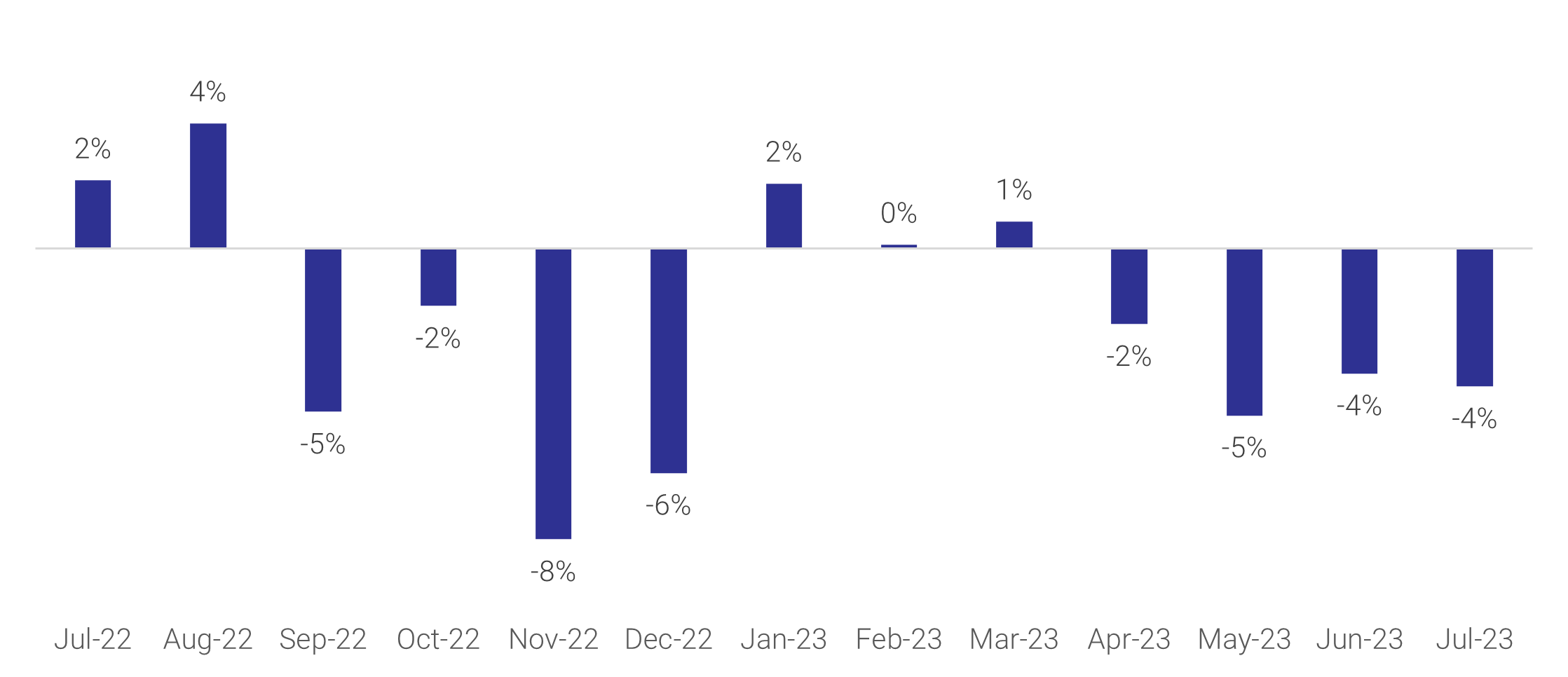

Job ads fell for a fourth month, dropping 4% in July. Volumes are now 26% down y/y and just 1% higher than July 2019 volumes.

Applications per job ad have increased by more than 10% for the past four months, rising 11% in June.

Figure 1: National SEEK job ad percentage change m/m July 2022 to July 2023.

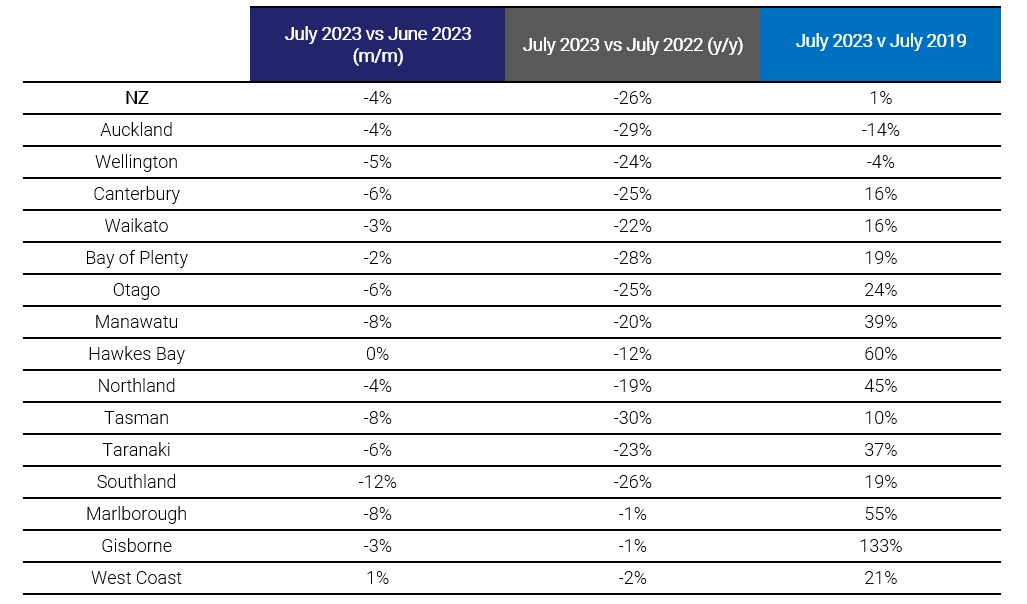

Table 1: National and regional job ad growth/decline comparing July 2023 to: i) June 2023 (m/m), ii) July 2022 (y/y) and iii) July 2019.

REGION INSIGHTS

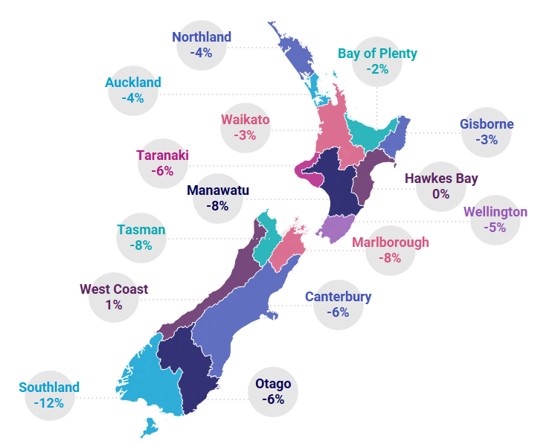

Most regions recorded a decline in job ad volumes in July, apart from Hawkes Bay, which recorded no change m/m and West Coast, which rose by 1%.

Declines in the largest regions drove the overall decline, with Auckland falling 4%, Wellington down 5% and Canterbury dropping 6%.

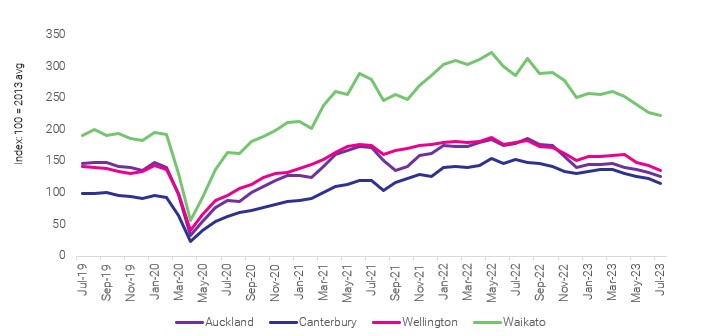

Job ad volumes remain higher than July 2019 levels in most regions, especially in the smaller regions of Gisborne (133%) and Hawkes Bay (60%). In fact, demand for workers in the smaller regions as a whole have demonstrated significant growth since July 2019, increasing 30%, while metro regions have declined 9%.

Applications per job ad rose in all regions, apart from Southland. There was a 17% increase in applications per job ad in Bay of Plenty, 14% in Waikato and 13% Auckland.

Figure 2: Region job ad volumes – July 2019 to July 2023

Figure 3: National SEEK job ad percentage change by region (July 2023 vs June 2023)

INDUSTRY INSIGHTS

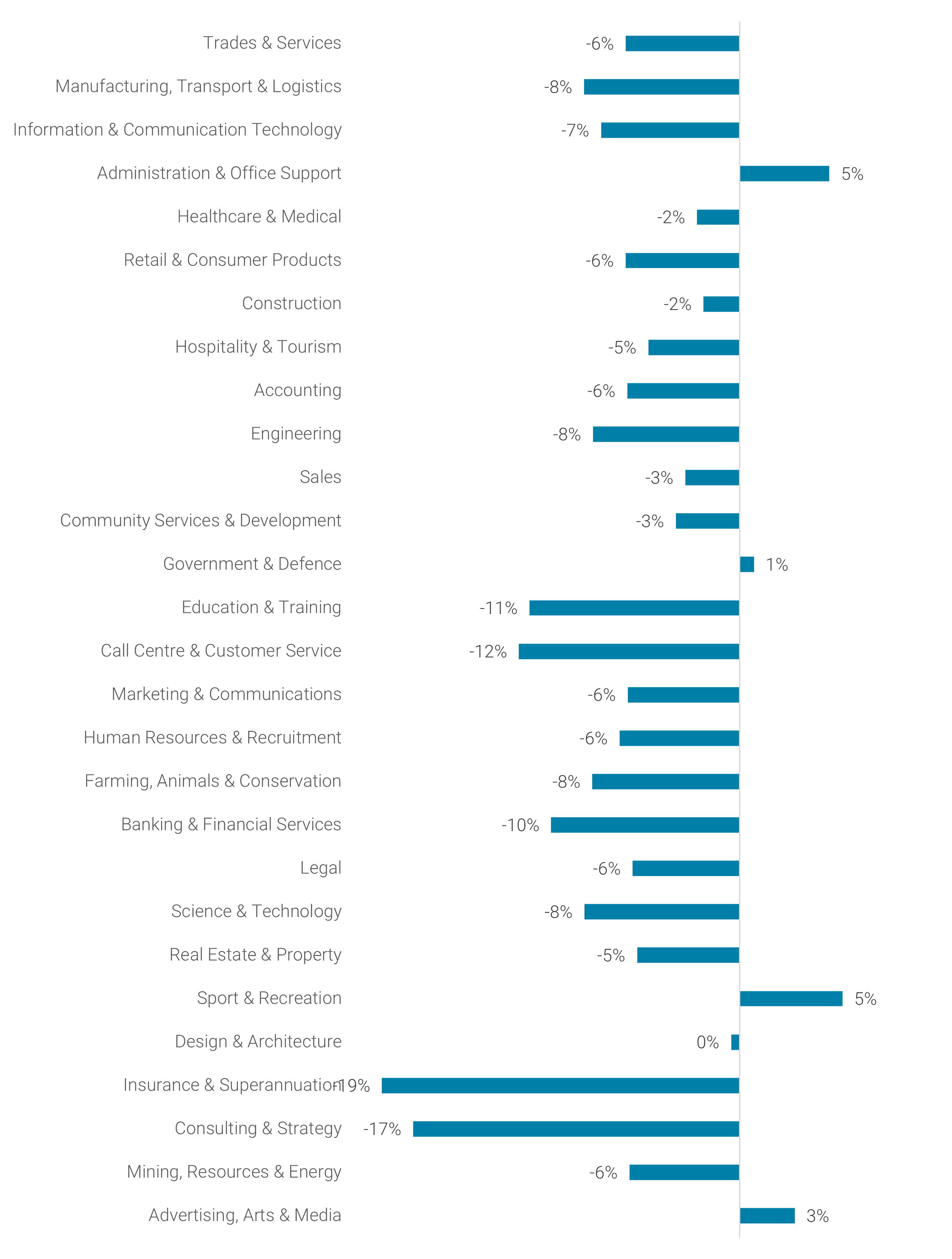

Four industries recorded an increase in job ads in July, including a 5% rise in Administration & Office Support and Sport & Recreation volumes.

The overall decline was driven by declines in the large industries of Manufacturing, Transport & Logistics (-8%), Information & Communication Technology (-7%) and Trades & Services (-6%).

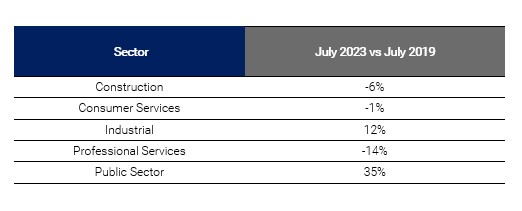

Despite this, there remains high demand for workers in some sectors in comparison to pre-COVID. Notably in the Public (25%) and Industrial Sectors (12%).

Applications per job ad increased from the month prior in all but four industries, including Manufacturing, Transport & Logistics and Community Services & Development which both rose by 24%.

Table 2: Job ad percentage change by sector (July 2023 vs July 2019)

Figure 4: National SEEK job ad percentage change by industry (July 2023 vs June 2023) – Ordered by job ad volume

Click here for the latest SEEK Employment Report data or for more employment insights or career advice please visit SEEK’s Hiring Advice or SEEK's Career Advice.

MEDIA NOTE: When reporting SEEK NZ data, we request that you attribute SEEK NZ as the source and refer to SEEK NZ as an employment marketplace.