2022 NZ Employment Market Year in Review

2022 has been a record-breaking year in the New Zealand employment market. The below outlines the four trends that have shaped the employment landscape since January.

2022 KEY TRENDS:

- Record job ad numbers, applications steadily grow

- Consumer-facing industries drive growth

- Hirers get creative to attract candidates

- Macro factors supersede seasonality

Rob Clark, Country Manager SEEK New Zealand says:

“Job ad levels reached record-levels in the first half of the year, culminating in over 38,000 ads on site in May. While ads have slightly decreased since then, they remain incredibly high compared to pre-pandemic levels, making for a very tight market, prologed over many months.

“Demand has been high in all industries, but especially so for consumer-facing roles, notably Hospitality & Tourism and Retail & Consumer Products – these two industries experienced the greatest increases over the course of the year. The seasonal increase in these roles traditionally expected in the lead-up to Christmas was not recorded, as demand peaked earlier in the year.

“As candidates have been in the driver’s seat all year, employers have been pulling new levers to try to attract applications, with “work from home” growing exponentially in the job ad lexicon, and references to sign-on bonuses growing over 300%.”

- RECORD JOB AD NUMBERS, APPLICATIONS STEADILY GROW

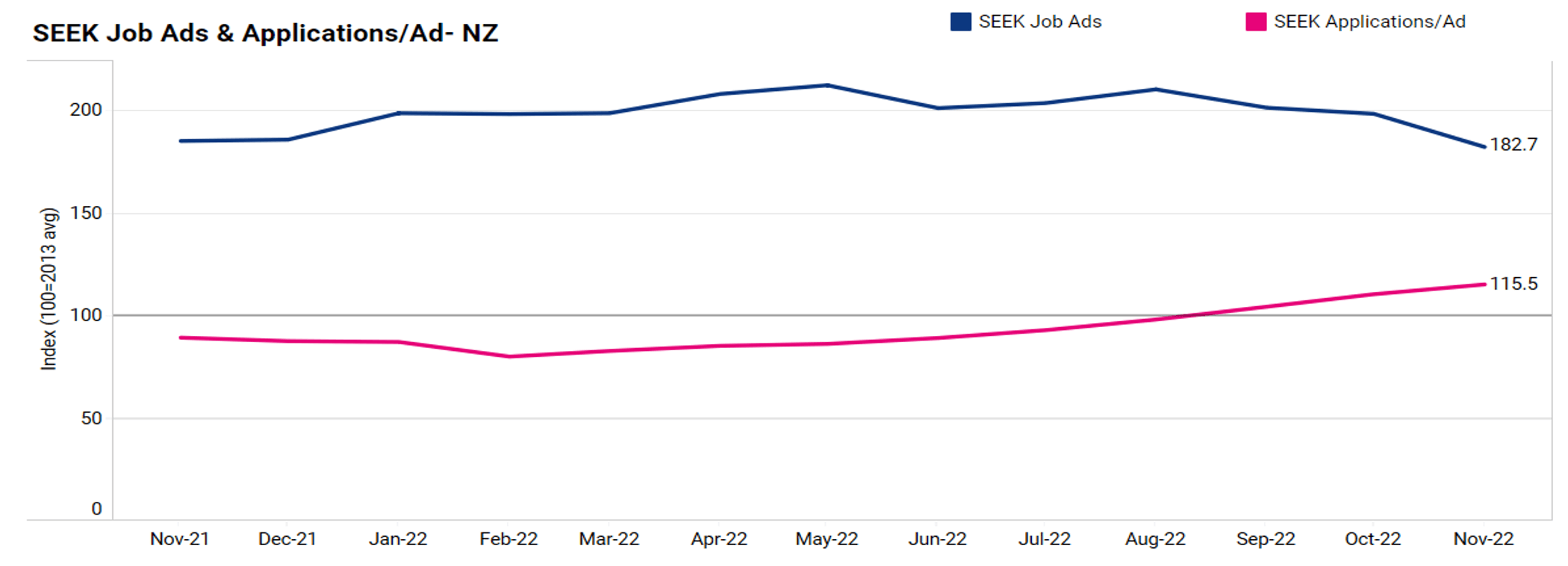

Between January and May, seek.co.nz had four months of record-level job ad numbers, peaking with over 38,000 job ads on site in May.

Job ads in every region reached record levels at some stage throughout the year from Manawatu and Tasman in February, to Marlborough in October.

Applications per job ad hit an historical low in January but have steadily risen each month since, returning to 2018-average levels by November.

Despite the peaks and troughs of ads and applications per job ad during the year, interest from applicants has been on the rise, with visitation to seek.co.nz high year on year, and particularly so over the past six months.

- CONSUMER-FACING INDUSTRIES DRIVE GROWTH

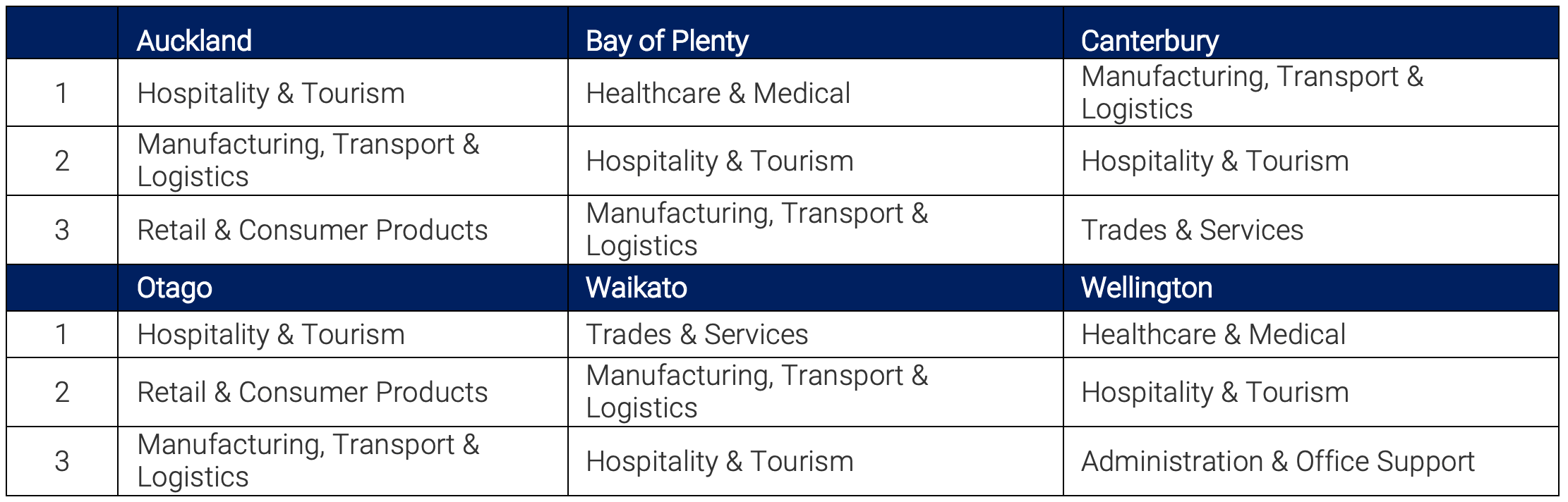

When comparing the quarter to November 2022 and the quarter to January 2022 the greatest drivers of job ad growth this year have been:

- Hospitality & Tourism

- Retail & Consumer Products

- Manufacturing, Transport & Logistics

- Community Services & Development

- Accounting

- Trades & Services (Canterbury & Waikato)

As one of the largest industries by volume, job ads for Information & Communication Technology (ICT) drove the largest decline, falling 16% between January and November, followed by Construction, which fell by 23% (but is smaller by volume). Applications per job ad for the ICT have risen 51% since the start of the year.

The industries that experienced the greatest growth per region were:

- HIRERS GET CREATIVE TO ATTRACT WORKERS

Record-level job ads and low applications per job ad resulted in an extremely tight labour market where candidates held more bargaining power than ever before and employers turned to new incentives and added benefits to attract candidates.

Sign-on bonuses became more commonly used with 349% more references to ‘sign-on bonuses' in 2022 compared to 2021[1].

Another notable trend in work perks was the promotion of flexible work options in job ads. The number of roles that mentioned “work from home” within the job description increased from approximately 160 per month in 2019 to 12 times as many in 2022[2].

Unsurprisingly, the largest increase in working from home roles were in the Public and Professional Services which saw significant growth (1349%) in job ads offering flexible work options since 2019. The Industrial, Consumer Services and Construction sectors are inherantly less likely to be able to offer work from home roles.

- MACRO-FACTORS SUPERSEDE SEASONALITY

COVID-recovery, rising costs of living and high demand for talent have been the greatest trends impacting the employment market in 2022, at times outweighing traditional seasonal trends.

While a slowdown in hiring in April would have been expected given the Easter and ANZAC Day public holidays, it was the third highest month for job ads on record.

Similarly, a pickup in hiring for temporary workers leading into the Christmas season was not recorded, with non-permanent roles or “Christmas jobs” not making a mark within the broader Great Job Boom. In fact, non-permanent job ads have remained at the incredibly low levels, as businesses focus energy on securing workers on an ongoing, full-time basis.

[1] Based on job ad volumes not sesaonally adjusted and based only on the following keywords: "SIGN ON BONUS”, "SIGN-ON BONUS", “SIGNON BONUS", "SIGNING ON BONUS", "SIGNING BONUS".

[2] Please note that the volumes of job ads are not seasonally adjusted and are based only on the following keywords: "WFH ,"WORK FROM HOME", "WORKING FROM HOME

MEDIA NOTE: When reporting SEEK NZ data, we request that you attribute SEEK NZ as the source and refer to SEEK NZ as an employment marketplace.